You’ve been here before. Three months of disciplined saving. That emergency fund creeping towards £5,000. You feel smugly responsible, maybe even screenshot your bank balance to savour the moment.

Then your mate suggests a weekend in Amsterdam. Or you spot the perfect vintage leather jacket. Or your business needs a rebrand right now.

Before you know it, you’ve blown through months of progress in a single weekend. And you’re back to square one, drowning in shame and promises to “do better next time.”

This isn’t about willpower. It’s about your nervous system treating financial progress like a threat.

Your Brain’s Secret Money Sabotage

Our minds are wired to maintain consistency with our identity. If “having money” doesn’t align with your internal story, accumulating wealth triggers psychological alarm bells.

Maybe money was always tight growing up, and your family bonded over being “skint but happy.” Maybe you watched your parents fight every time there was cash in the account. Maybe you learned that people with money were selfish, or that wanting more made you greedy.

In that context, your nervous system learned: money = danger.

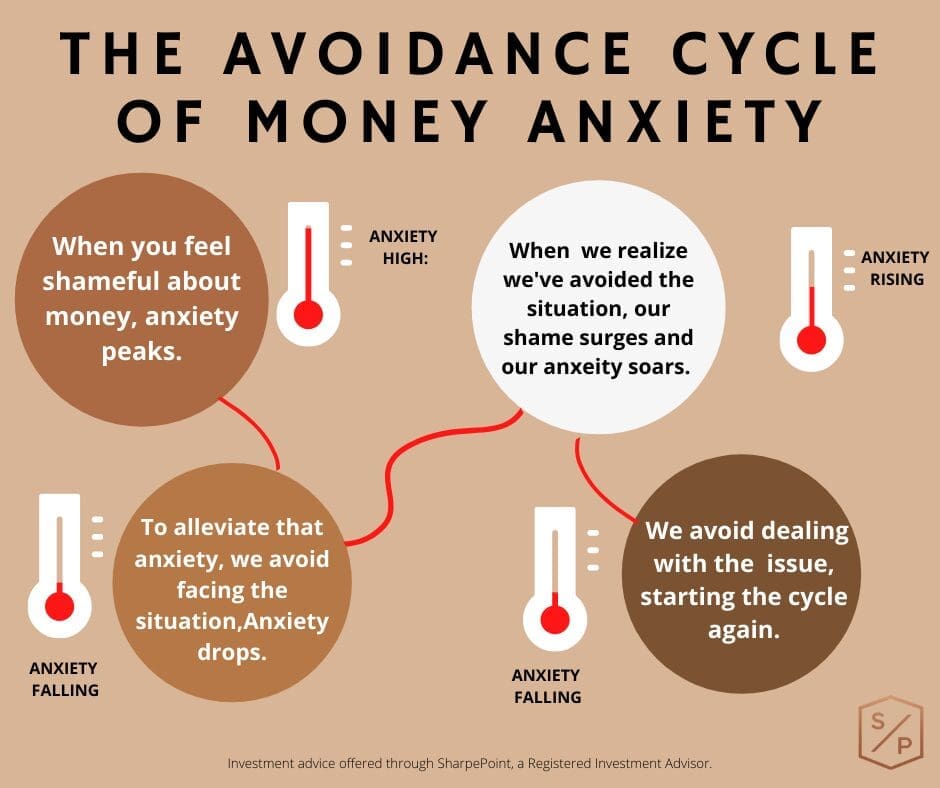

So when your savings hit a certain threshold, your brain doesn’t celebrate. It panics. The splurge isn’t really about the jacket or the trip — it’s your mind yanking you back to familiar territory where you’re safely, predictably broke.

The Snap-Back Always Comes After Success

Notice how self-sabotage rarely strikes when you’re already struggling? It’s the psychological rubber band effect, the further you stretch from your comfort zone, the harder your brain pulls you back.

And the cruel part is that your mind will make the spending feel completely justified in the moment. I work so hard, I deserve this. Life’s too short. This will make me happy.

You believe the story. You swipe the card. For exactly thirty seconds, relief floods your system as you snap back to “normal.”

Then the shame spiral begins.

You beat yourself up for lacking discipline. You promise to start again Monday. And that self-criticism only strengthens the identity loop: See? I’m rubbish with money. I always mess this up.

Which makes the next blow-up inevitable.

How to Make Financial Progress Feel Safe

The solution isn’t more willpower or stricter budgets. It’s rewiring your nervous system so growth feels safe instead of threatening.

Start with the story audit. What did having money mean in your family? Was it fought over, hidden, or spent the moment it arrived? These patterns are running your financial decisions whether you realise it or not. Name them to claim them.

Then, give your money specific jobs. Instead of one intimidating “emergency fund,” create smaller, purposeful buckets: car MOT fund, friend’s wedding fund, business tax buffer. Same money, but now it serves practical purposes instead of triggering your “who am I to have savings?” alarm.

Finally, celebrate the identity shift, not the perfection. Stop saying “I’m good at saving” — that’s performance pressure. Start saying “I’m someone who plans for my future” — that’s growth identity. When setbacks happen (and they will), they become data points, not character flaws.

Beyond Quick Fixes

If this cycle has been running your financial life for years, surface-level tactics won’t cut it. You need to rewire the deeper patterns that keep pulling you back into familiar chaos.

That’s exactly what we tackle in my private coaching. Not another budgeting system or spending tracker, but a complete nervous system reset around money. We identify your specific sabotage patterns, build financial strategies that feel sustainable instead of scary, and create a money flow that supports your actual life, not some fantasy version where you never want anything.

Because your savings shouldn’t feel like a house of cards waiting to topple. And your progress should compound, not constantly reset to zero.

share