You’ve followed every piece of financial advice to the letter. Built that six-month emergency fund. Automated your savings. Hit the milestone that’s supposed to guarantee peace of mind. So why are you still feeling anxious about money?

Why does every unexpected expense, even a small one, send your heart racing? Why does “financial security” feel more like financial surveillance, with you monitoring every dollar like it might disappear overnight?

The unspoken truth about saving that glorified “3-6 Month Emergency Fund” is that hitting a number doesn’t automatically create safety. Not the kind that actually matters.

The Real Reason More Money Doesn’t Fix Money Anxiety

Financial anxiety lives in your nervous system, not your bank account.

If you grew up watching parents stress over bills, experienced financial instability, or absorbed the message that money equals survival, your brain developed an early warning system. One that doesn’t simply switch off because you’ve built a cushion.

Your nervous system is still scanning for threats. Still treating every financial decision like a potential catastrophe. Still convinced that safety is one bad month away from vanishing entirely.

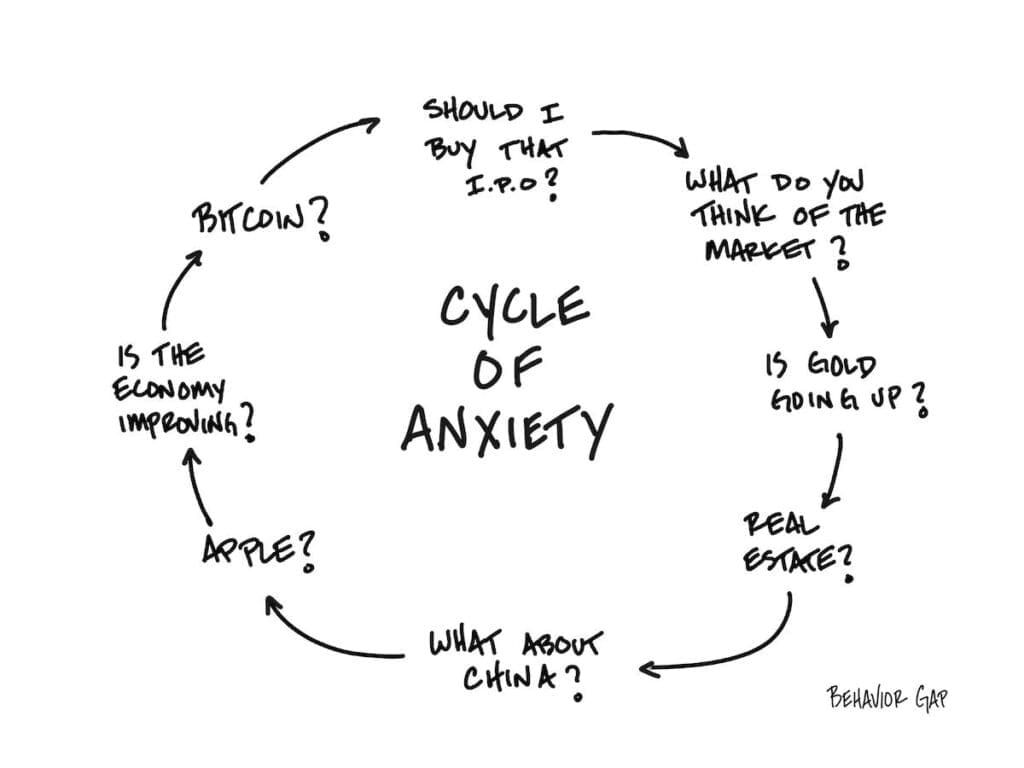

The result? You’ve achieved the goal, but you can’t enjoy it. Instead, you’re trapped in a cycle that looks like this:

You check your balance obsessively, because your brain demands constant proof that the danger hasn’t returned. The initial relief of reaching your savings goal fades fast (hello, hedonic adaptation), leaving you wondering if six months is actually enough. The goalpost shifts. Nine months would be safer. Twelve would be better. What about a recession? What if you get sick? The anxious mind can always find another hole to worry about.

No milestone ever feels sufficient because you’re trying to solve an emotional problem with a mathematical solution.

The Checking Trap

Here’s the cruel irony: the more you monitor your money for safety, the less safe you feel.

Every balance check sends a signal to your nervous system: “This is fragile. This needs watching.” Which only reinforces the anxiety you’re trying to escape.

That’s why another budgeting app won’t fix this. You don’t need better numbers, you need a fundamentally different relationship with the numbers you already have.

Retraining Your Nervous System

Real financial security isn’t about accumulating more. It’s about teaching your body to recognize safety in what you’ve already built.

Start here:

Limit the checking. Move from daily balance monitoring to weekly. When you do check, pause and consciously acknowledge: “I have £X. That covers Y months of expenses. Right now, in this moment, I am financially safe.”

Create evidence anchors. Write down concrete ways your current situation differs from past financial instability. Keep these reminders visible, on your bathroom mirror, in your wallet, wherever you’ll see them daily.

Practice embodied safety. When reviewing your finances, take three deep breaths. Soften your shoulders. Let the reality of your security settle into your body, not just your logical mind.

These aren’t just mindset tricks. They’re nervous system interventions that help your body catch up to your bank balance.

When Numbers Aren’t Enough

If this hits close to home, know this: you’re not broken, and you’re definitely not alone. You’ve simply been trying to solve a nervous system problem with spreadsheet solutions.

This is exactly why I created Overflow, a three-month private coaching experience for high achievers who are tired of feeling anxious about money they’ve worked hard to save.

Overflow isn’t about earning more or budgeting harder. It’s about rewiring your relationship with money from the inside out, blending practical financial strategies with nervous system healing and behavioral change.

My clients don’t just hit their financial goals, they learn to feel safe enough to enjoy them. They spend without guilt, save without obsession, and finally use their money to build the life they actually want.

Because what’s the point of financial milestones if your nervous system never gets to celebrate them?

share